Progress Money Community is amongst the easiest approaches to get funding to your present business. Because 2007, we recognized ourselves as a leader while in the small-medium sized business marketplace.

Devices funding loans can only be utilized for machinery and identical tangible assets, so if you'll want to buy inventory or worker salaries, think about a loan with a lot less strict usage stipulations.

Expression business loan We don’t just take a look at credit rating scores; we see your business potential. Funding in just 4 hrs, without having concealed fees. Study Much more

By means of Bill factoring, a business can use its invoices to borrow the amount its shoppers can pay Later on: The lender receives the Bill and its foreseeable future payment, although the business receives small-phrase funding.

Service provider funds advance Require resources quickly? Our service provider income progress is ideal for quick funds boosts, with easy, fast processing to assistance your business’s requires. Study Much more

Any matching request submitted by our Web site would not constitute a loan application and you'll need to submit a loan application to your respective lender before the lender provides you with an genuine offer you. We do not warrant that you'll be authorized for the loan, nor that you will be available a loan Using the identical phrases introduced on our Internet site.

We are not an financial commitment adviser, loan supplier, or simply a broker and we do not offer loans or home loans directly to conclude consumers, but only allows end users to match with lending associates and platforms that could prolong a loan. All loan acceptance decisions and conditions are based on the loan companies at the time within your application with them.

Bio: McKayla Girardin is a highly skilled finance and business author located in New York City. She's excited about reworking advanced ideas into very easily digestible content articles to how to get a corporate loan assist anybody superior realize the world we reside in. Her get the job done continues to be showcased in a number of reliable stores, which includes MSN and WalletHub.

Business line of credit score Versatile money when your business needs it. Our line of credit features easy accessibility to dollars, serving to you cope with sudden fees. Go through Much more

A Doing the job cash loan is a brief-time period sort of funding that provides businesses the money to fund everyday operations. These loans need to be repaid rapidly, usually in under 24 months, in order that they’re not designed for larger sized or costlier business investments, like real estate property or equipment purchases.

BestMoney measures person engagement determined by the amount of clicks Every mentioned model obtained in the past seven days. The volume of clicks to each manufacturer might be measured versus other manufacturers listed in a similar query.

Company listings on this website page Never imply endorsement. We do not characteristic all suppliers on the market. Except as expressly set forth in our Terms of Use, all representations and warranties with regards to the data introduced on this web site are disclaimed. The data, which include pricing, which seems on This great site is issue to vary Anytime.

We offer your business with numerous funding options until eventually we find the a person that works best in your case. We by no means cost any upfront fees.

Be sure to qualify. Overview your along with your business’s economic scenario to understand which loans you can get.

Service provider cash improvements (MCAs) make it possible for businesses to borrow lump sums of profit exchange for any proportion of upcoming credit and debit card product sales. Contrary to a standard loan, an MCA isn’t lending money using a guarantee of repayment; it’s buying a business’s long run gross sales.

Gia Lopez Then & Now!

Gia Lopez Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now! Justine Bateman Then & Now!

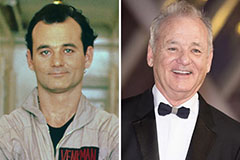

Justine Bateman Then & Now! Bill Murray Then & Now!

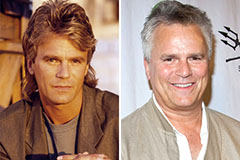

Bill Murray Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!